Crypto Markets

Crypto Sentiment

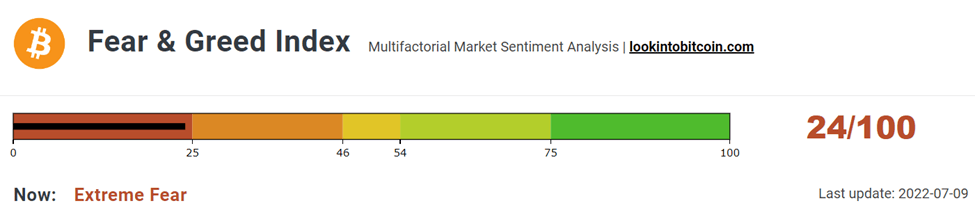

This week the sentiment towards the cryptocurrency markets improved significantly

compared to last week’s index. The index currently stands at “24”, nearly out of the

“Extreme Fear” zone.

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week stands at 0.98. During bear markets we have previously seen

that the metric oscillates below 1. As the aSOPR reaches a value of 1, investors start

selling their coins and the metric falls below 1. The oscillation continues for an

extended period of time before final capitulation happens and trend reverses

Is there any demand for Crypto?

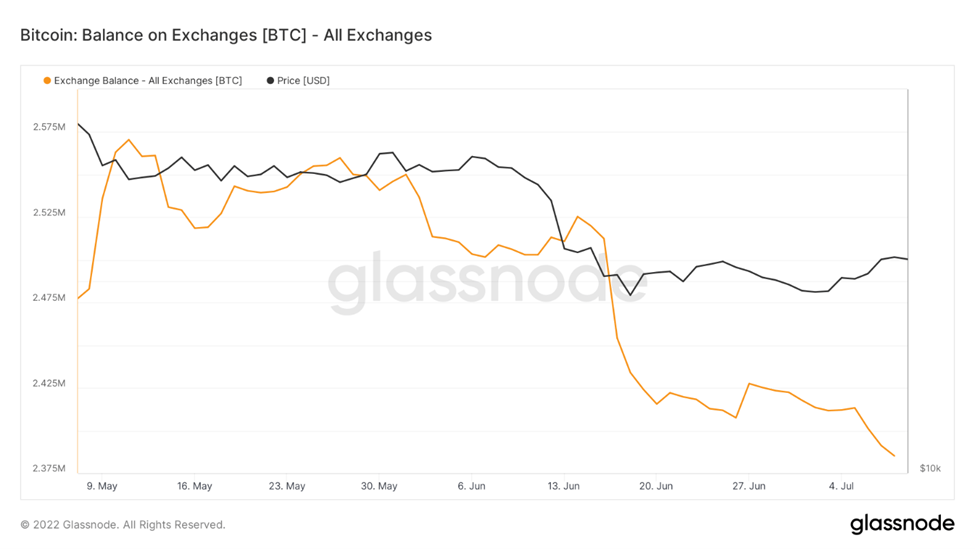

The balance on exchanges has reduced significantly and is at the same level as it was

in July of 2018. Due to the decrease in prices of cryptocurrencies, exchanges are facing

a liquidity crunch. In the past few weeks, there had been instances of some exchanges

suspending withdrawals. This has created panic among investors and consequently

has led them to transfer coins to their wallets.

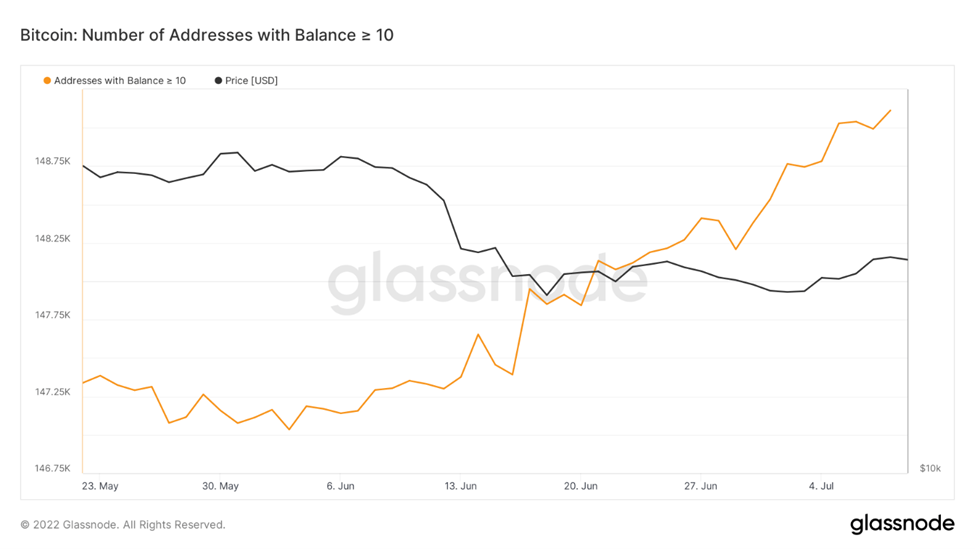

Even though the number of addresses with balance more than 10 is not at an all time

high, the upward trend suggests, that the metric is improving.

What could play out?

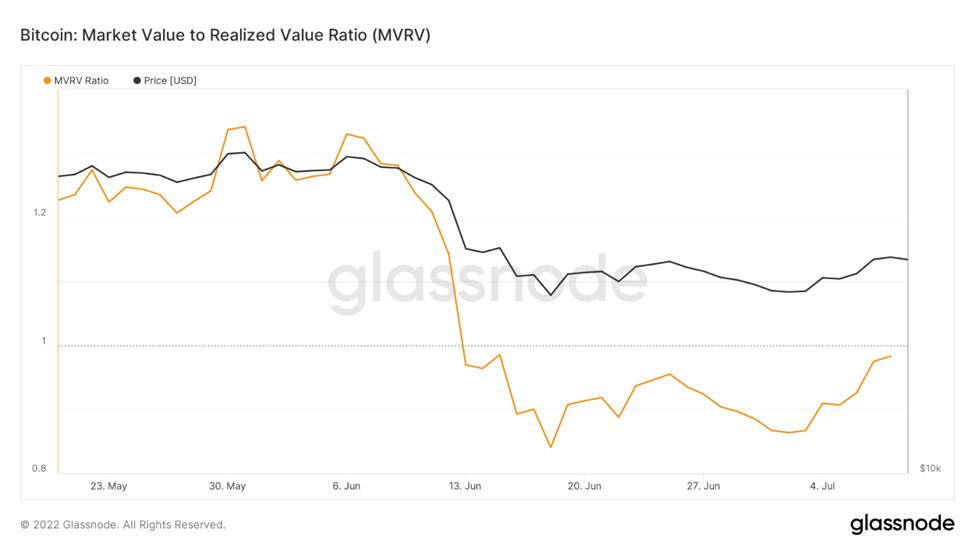

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

So, for example if the price of most of the Bitcoin when they last moved was $10,000

and the current price is $60,000. Then the MVRV ratio would stand at 6. This means

that the market is extremely heated and profit booking is likely. On the other hand, if

the of most of the Bitcoin when they last moved was near the market price, then the

CMP can be considered as the bottom.

MVRV ratio has increased to 0.98 compared to last week’s value at 0.86. The metric is

oscillating below 1 which is the general trend in most of the bear cycles.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average jumped up marginally(0.77%) in the last week. The daily

chart for Dow Jones continues to move in a megaphone down pattern. The next

support is expected at 28,900.

GOLD FUTURES

Gold Futures dropped drastically last week, 3.3% to be precise and closing in red for

the 4th consecutive week. The weekly trend for Gold broke out below the triangle

pattern. An immediate support is expected at $1,670

BITCOIN

Bitcoin gained back all of the 8% last week that it lost in the week before, edging above

$22K. The 4-hourly trend for BTC broke out of the triangle pattern and is retesting the

pattern. The next resistance is expected at $32.3K and key support is expected at $14K.

ETHEREUM

Ethereum against BTC remained neutral the last week. The weekly trend for ETH-BTC

continues to traverse within an ascending triangle pattern, trading at support levels.

The next resistance is expected at 0.076 and an immediate support is expected at 0.046

Highlights of the week

TikTok’s former executive Jason Fung has ventured into the

blockchain space with a gaming startup called Meta0.

The startup is trying to solve some of the gaps in the

blockchain games space, especially in terms of

infrastructure segregation

Intel has commenced shipping Blockscale ASIC Chips to

selected Bitcoin Mining companies. The technology giant

had earlier announced the launch of its “ultra-low-voltage

energy-efficient” ASIC chip, and it has already arrived.

Vauld, a crypto lender backed by Coinbase, suspends

trading, deposits, and withdrawals, due to current “market

conditions.”

Our Pick of the Week

Enjin (ENJ)

We expect a gain of 10% from the Buy Price of 0.5437 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today