WEEKLY MARKET REPORT – 3rd October’22

What is the general sentiment for Crypto?

The sentiment towards the cryptocurrency market is in the extreme fear zone and compared to last

week’s, the Fear & Greed Index has decreased from “24” to “20”.

Another data to evaluate the sentiment of the general public would be to look at Spent Output Profit

Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have sold at a profit or if they sold at

a loss. An SOPR value above 1 indicates that profit booking dominated loss booking and below 1

indicates that loss booking dominated profit booking. A value of 1 indicates that the coins were sold at

their purchase price. Adjusted SOPR filters out transactions that are younger than 1 hour, thus, clearing

out noise from the metric.

we see that the metric value of 1 acts as resistance during bear market. For strong confirmation of trend

reversal the metric should stay and oscillate above 1.

Are Long-Term Holders Selling Their Coins?

Coin Days Destroyed (CDD) is calculated as the sum value of the number of days between created and spent multiplied by the UTxO amount.

When the metric value increases this indicates that long-term coins are moving in great amounts which might lead to huge volatility in prices or signal trend reveral. On the contrary, when the metric value decreases this indicates long-term holders are moving their coins in less amount.

Currently, the metric is at two year low which indicates that the amount of coin age that is being spent in the system is almost non-existent.

Exchange reserve is one of the important metrics to determine the potential number of coins with a high probability of getting spent in the market.

Exchange reserve increases: Liquid supply increases, selling pressure increases

Exchange reserve decreases: Illiquid supply increases, selling pressure decreases

Compared to last week, the metric has decreased significantly which indicates that selling pressure has decreased which might lead to increase in price.

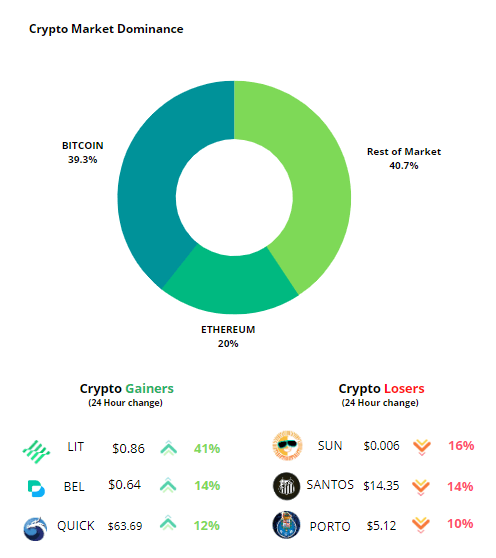

Overall Market Performance

Dow Jones

Dow Jones Industrial Average dropped by 3% in the previous week. The weekly trend for Dow Jones has formed a descending channel pattern with a bounce-back expected from the lower trendline. The next support is expected at 27,800 level.

Gold

Gold Futures climbed up by 1% in the last week after closing in RED for 2 weeks. The weekly trend for Gold has formed a descending channel pattern. The next support is expected at $1,532

Bitcoin

Bitcoin remained fairly neutral during the previous week, closing in the green. The weekly trend for BTC continues to traverse within a descending triangle pattern. The next resistance is expected at $32.3K and key support is expected at $17.9K

ETHEREUM

Ethereum closed 3% lower against Bitcoin in the last week. The 4-hourly trend for ETH-BTC is moving within the descending triangle pattern. The next resistance is expected at 0.088 and next support is expected at 0.063.

Highlights of the week

Non-fungible tokens (NFT) have finally arrived on Instagram. Users can connect wallets from Coinbase, Dapper Labs, MetaMask, Rainbow and Trust to Instagram.

Polygon has a large user base of about 170 million addresses, of which some 300,000 are classed as active & it’s growing at a pace of 80,000 new users a day. The reason for the adoption of Polygon is because it has lower gas fees and availability of trading platforms such as Opensea and Uniswap.

Walmart has created two experiences, one called Walmart Land and the other Walmart’s Universe of Play. Walmart Land will include a virtual merchandise store, while Universe of Play contains various toy worlds and games.

Our Pick of the Week

Chromia (CHR)

We expect a gain of 10% from the Buy Price of 0.1506 USDT and outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today