THORChain is an open-source blockchain-based decentralized protocol for performing cross-chain transactions permissionless.

The CMP of RUNE is $2.90.

The problem statement:

A Decentralized Exchange (DEX) called Uniswap is based on an Ethereum blockchain network where you can swap crypto tokens. But the problem is you can only swap Ethereum-based crypto tokens. Non-Ethereum based crypto tokens can be listed in a derivative form. So Uniswap doesn’t have cross-chain functionality.

Most transactions happen on exchanges like Coinbase, Binance, FTX, etc., which are centralized. Suppose if there is a hack on the exchange there is a high risk of losing all your assets as centralized exchanges have full custody of funds.

As they handle most of the crypto transactions, they will become the banks in the future of this industry.

There’s a need for a solution where all assets are interoperable with each other & no single(or few) platform or network should be dominant.

THORChain tries to solve these problems. Let us understand about THORChain blockchain network.

What is THORChain?

THORChain is a cross-chain Decentralized Exchange (DEX) for swapping different blockchain assets.

It’s a Layer-1 blockchain network built with Tendermint & Cosmos SDK & utilizes Threshold Signature Scheme(TSS). Due to this, THORChain can be interoperable with other blockchain networks.

What is Threshold Signature Scheme(TSS)?

Threshold Signature Scheme allows you to use a distributed key generation, signing & verification method that allows you to achieve higher levels of security.

Functionalities of THORChain:

1) Swap two crypto assets of different blockchain networks. For example, you can swap ETH(Ethereum) with BNB(Binance coin) in a decentralized & non-custodial way.

2) Earn passive income by depositing your crypto assets.

As of now, the protocol only supports seven significant cryptocurrencies:

Bitcoin(BTC)

Ether (ETH)

Binance coin (BNB)

Dogecoin (DOGE)

Litecoin (LTC)

Bitcoin cash (BCH)

How does it work?

THORChain uses Threshold Signature Scheme(TSS) to secure its Vault. It requires a consensus of two-thirds majority funds to enter & exit the primary TSS.

THORChain has four kinds of users:

Swappers: To swap crypto assets, they use liquidity pools.

Node operators: Node operators secure the system & provide the bonds.

Liquidity providers: Add liquidity to protocol & earn the reward.

Traders: They monitor & rebalance pools to earn profits.

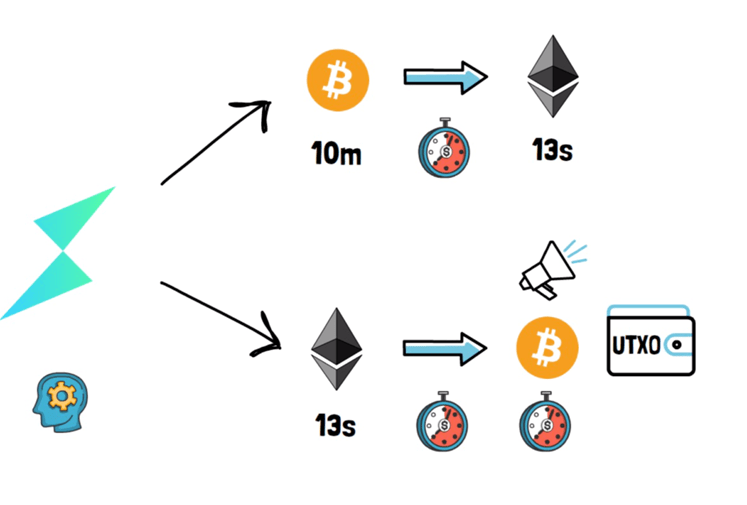

THORChain doesn’t wrap before swapping crypto assets & uses native assets to swap assets.

Liquidity pools perform assets swap & liquidity providers contribute to them. Liquidity providers have to deposit their assets & in return they earn from system rewards & swap fees.

Node operators secure the network & in exchange, they earn rewards from swap fees for every swap. A node operator has to initially provide a bond of RUNE as collateral which is two times the RUNE pooled.

For example, if one wants to swap from ETH to BTC, the swappers will send ETH to THORChain. After entering ETH into the THORChain network, there will be ETH to RUNE swap & RUNE to BTC swap. THORChain Vault will then send BTC to the swapper. This swapping is caused with native assets without wrapping assets.

How is it Unique?

THORChain’s DEX doesn’t require wrapping for swapping crypto assets.

Swappers & traders:

1) It can perform swapping with layer-1 native assets across different blockchain networks.

2) The transactions are transparent without depending on a centralized 3rd party.

3) Liquidity is available on demand.

Liquidity providers:

1) They can earn a yield of assets like BTC, ETH, and BNB.

2) They are no lock-in periods.

3) No requirements for dealing with 3rd parties.

Node operators:

1) By securing the network, they earn a reward.

2) They are anonymous to augment decentralization.

Tokenomics:

The native token of THORChain is RUNE. The maximum supply of RUNE is 500 million & ~67% of the total maximum Supply(334.9 Million) is in circulation. Initially, it had a maximum collection of 1 billion RUNE, but they reduced it to 500 million in October 2019.

There are four use cases of RUNE:

Settlement Asset:

A 1:1 ratio of RUNE: ASSET is required in each pool. A pool of $1000 of ETH will need to hold $1000 of RUNE.

Security:

Node operators have to ensure the network’s security, so they have to bond twice the RUNE to the amount added to the pool & bonds are kept as collateral.

Governance:

The user can choose which asset they give priority by voting. If a pool has higher RUNE, they get priority.

Incentives:

Node operators & liquidity providers are paid block rewards & swap fees. Gas fees can also be paid by RUNE.

Competition analysis:

THORChain vs. REN:

THORChain can perform asset swapping in a decentralized manner without wrapping. It uses its native token RUNE for asset swapping. First, the Asset is sent to the THORChain network & it will be swapped with the native token RUNE & the RUNE will swap the new asset token the user requires. But till now, only seven tokens are supported by THORChain that we discussed above.

But REN can also perform asset swapping, but there is one limitation. While performing a transaction, the user’s assets will be locked & can only swap the asset with ETH. But with THORChain, a user can swap with a few more supported assets by wrapping.

The market cap of RUNE is $952 million & REN is $176 million.

Team, Media & community strength:

There is no Director, Founder, or CEO of THORChain, but there are some leads & the developers are self-organized using Gitlab.

The main reason for remaining anonymous is to maintain the decentralization of the project.

THORChain has a big community & it has 187.9k followers on Twitter. It has 11.5k members on Reddit. THORChain project was launched in 2018.

Conclusion:

THORChain, as a cross-chain DEX in DeFi, is opening the road for autonomous asset exchanges. RUNE’s architecture as a settlement, security asset, governance, and incentive tool enables the implementation of THORChain’s native swap model in a decentralized environment and across different blockchains. Thorchain’s team thinks that their cross-chain exchange protocol is only the beginning. They intend to create a protocol for the whole DeFi ecosystem, allowing borrowing, and lending services over many blockchains.

Pros & Cons:

Pros:

1) Cross-chain functionality:

A user can swap a crypto asset with another crypto asset irrespective of whether the blockchain network is the same or not.

2) Decentralization & privacy:

THORChain is a decentralized exchange so one can use the network in a non-custodial manner. Also, the identity remains anonymous & there is no requirement of KYC.

3) Security Auditing:

THORChain had been hacked in July 2021 & lost $8 million. After that THORChain has gone through multiple security audits.

Cons:

High transaction fee:

Currently, THORChain network has very high transaction fees & they are working on making some structural changes to reduce it in the future.

Low Total Value Locked:

The total value locked currently is very low & there is a need to reduce the high transaction fee for more adoption of the network.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today