Research summary:

Synthetix is a Defi project (live and operating) that allows anyone to gain exposure to a vast range of assets without any geographical limitation. We will focus on how the project works, what value it adds, and review its pros and cons.

The CMP is $12.77, as of 2nd September 2021

What is DeFi?

All of the traditional financial services are centralized (controlled by a single authority or managed in one place) in nature. The Risks and problems that come with centralized financial services are Fraud, Mismanagement of funds, Theft, and restrictions to use your own money. DeFi stands for Decentralized Finance (DeFi is a category of Dapps. Dapps are decentralized applications that are launched on networks such as Ethereum). It is a financial service with no central authority. It eliminates these problems by allowing people to have complete custody and control of their money and to get more returns, by eliminating the 3rd party.

There are various categories of DeFi

• Money Market: Such applications enable users to borrow assets against collateral and earn interest. Maker, Aave, and Compound are the top DeFi applications in this category.

• Decentralized exchange: These kinds of applications give users the ability to swap one crypto for another. Uniswap and Sushiswap are the top DeFi applications in this category.

• Derivatives: A derivative contract derives its value from an underlying asset. With the help of smart contracts, DeFi projects like Synthetix allow people to get exposure to a wide variety of assets.

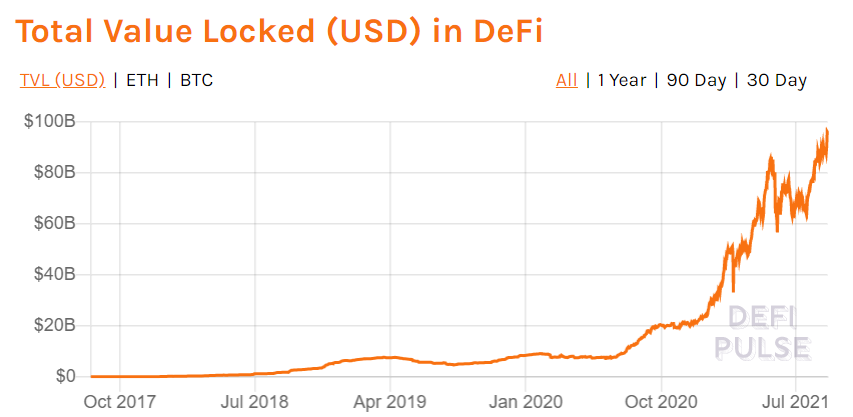

The DeFi space has seen explosive growth over the past year. The graph below indicates that 95.96 billion dollars are currently involved in the DeFi space.

What is a Synthetic Asset?

Similar to traditional financial derivatives, which derive their value from other underlying assets like commodities, currencies, precious metals, stocks, or bonds, synthetic assets aim to achieve the same objectives without the necessity of holding the actual asset itself.

For example, let’s say that there is a cricket fantasy league app, where you can buy players and have them on your team. When the player (Let’s say Dhoni) performs well in the real world, the very same player in the game will also play well. In this example, you have a synthetic asset (The player) without actually owning the real player in your team.

Very popular synthetic assets that every crypto investor is familiar with are stable coins. USDC behaves like a USD but is not a USD.

What is Synthetix?

Synthetix (Previously known as Havven) is a decentralized synthetic assets issuance and trading platform built on the Ethereum network. The synthetic assets include cryptocurrencies, equity, commodities, and even fiat currencies. As long as there is a price feed for an asset, a synthetic asset can be created.

Synthetic assets serve one major benefit “Convenience”. You don’t have to go to the NYSE to buy equity, Binance to buy crypto and you don’t need to go to CME to deal with commodities and currencies. You can get exposure to all the assets with the help of synthetic assets.

The total value locked (TVL) with Synthetix is $1.8 billion and has a Mcap-TVL ratio of 0.752.

It is currently ranked at #78 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 250 million SNX tokens out of which 114 million SNX tokens are in circulation. SNX is currently listed on Binance, Coinbase, and Huobi Global.

How does Synthetix work?

Kwenta.io is the exchange that operates on the Synthetix protocol, where you can buy and sell synthetic assets or synths. It isn’t like the traditional exchange where a buyer and seller are matched (Peer to peer). It is a peer to contract (P2C) trading. This means that All trades are executed against the Synthetix smart contracts, so traders don’t have to worry about the limitations of the peer-to-peer trading model, such as liquidity, slippage, or order books.

You need to connect your web3 wallet (You will have complete custody of all the tokens you purchase) and buy sUSD (Synthetic USD) from the exchange or from other decentralized exchanges. Once you buy sUSD you can start trading the sUSD with other synths. Something interesting happens when you trade. As this is a P2C when I buy 1 sEther for 4000 sUSD, the 4000 sUSD is destroyed and 1 sUSD is minted. This allows for no liquidity and slippage issues, unlike other decentralized exchanges.

Just like stable coins, each synthetic asset has collateral (in the form of SNX tokens) behind it. Synths are minted when SNX holders stake their SNX as collateral using Mintr, a decentralized application for interacting with the Synthetix contracts. Synths are currently backed by a 750% collateralization ratio, although this may be raised or lowered in the future through community governance mechanisms. So, if I want to mint 1 sUSD, I will need to back it up with $7.5 worth of SNX token. The over-collateralization is to absorb price shocks.

SNX stakers incur debt when they mint Synths, and to exit the system (i.e unlock their SNX) they must pay back this debt by burning Synths. The debt will be the current value of the synth they minted. This means that the debt can increase or decrease independent of its original minted value, based on the exchange rates and supply of Synths within the network. For example, if 100% of the Synths in the system were synthetic Bitcoin (sBTC), which halved in price, the debt in the system would halve, and each staker’s debt would also halve. This means in another scenario, where only half the Synths across the system were sBTC, and BTC doubled in price, the system’s total debt—and each staker’s debt—would increase by one quarter. In this way, SNX stakers act as a pooled counterparty to all Synth exchanges; stakers take on the risk of the overall debt in the system.

You can also purchase inverse synthetic assets, which is essentially equivalent to shorting the asset.

What is the utility of the SNX?

SNX is an ERC-20 native token to the Synthetix ecosystem. It represents a core element in the Synthetix ecosystem. Whenever a new synth is minted, the SNX token is considered collateral. The collateral is locked and can be also considered as staked. The system is designed in such a way that each synth is backed by the Synthetix Network Token (SNX), which is staked as collateral at a ratio of 750%. If this ratio is below 750%, the stakers won’t be eligible for the 0.3% fee on each exchange occurring.

In order to increase the number staked SNX, the tokenomics had inflation designed into it. So a person who does not stake SNX will be losing 22% APY (Current rate) compared to a normal holder.

Competition analysis.

When it comes to derivatives in the Defi space, Synthetix has the highest amount of Locked value and has a dominance of 53.23%.

Team, Media, and community strength.

Synthetix originally was a project referred to as Havven which was focused on creating collateralized stablecoins but evolved. The leadership team has strong experience in the field of Finance & Technology. Synthetix also has excellent community strength, they have 150k Twitter followers and 31k discord members. Their media presence is however not very impressive.

Conclusion

Pros: Synthetix is dominating the derivative space in the DEFI. It has huge market potential as the traditional markets are beyond trillions of dollars and Synthetix can create any synthetic asset. The native token is also vital in the ecosystem and is designed to be staked, locking up most of the supply.

Cons: Some Synths can be classified as securities and could potentially come under the existing regulations. The price feeds for the assets are a potential weak spot for the project. If by any chance, it is manipulated the entire system could be subject to fraud and deceit. The stakers face a risk of burning more synths to unlock their SNX tokens.

MintingM rating for Synthetix is 3.9/5

| Criteria | Score |

|---|---|

| Industry | 5.0 |

| Opportunity Size | 5.0 |

| Competitive advantage | 2.5 |

| Tokenomics | 2.63 |

| Team | 4.16 |

| Overall Score | 3.90 |