Decentraland Research Report

Research summary:

This research report is focused on Decentraland which is an upcoming project operating in the gaming industry. We will focus on how the project works, its tokenomics, and review its pros and cons. It is currently listed on Binance, Coinbase, Bithumb, & more.

The CMP is $0.52 as of 25th June 2021.

What is Decentraland?

Decentraland is a decentralized project that operates in the gaming industry (An industry that is slowly getting exposure to blockchain technology).

It is a virtual world owned by its users & you can Explore, Create and Trade in this virtual world.

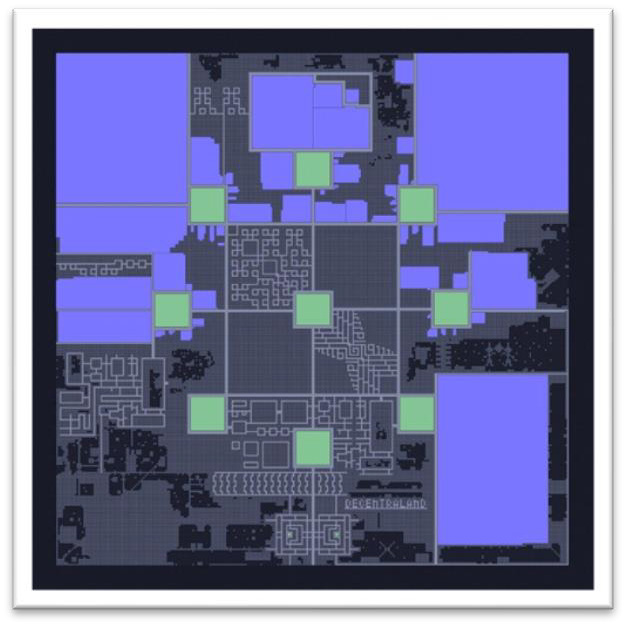

Decentraland is a virtual world with 90,000 Parcels (or plots) of land. The lands are NFTs and will be completely owned by the purchaser (Do read our report on Ethernity Chain to know more about NFTs). At the Launch of the virtual world, most of the parcels of lands were sold. The value of these lands behaves similarly to the prices of actual real estate. Land closer to the roads is more expensive and land which isn’t accessible is relatively cheaper. Below is the map of Decentraland along with the listing of one parcel of land (Which is currently going for approximately $5,200).

The most expensive Land TRADED for nearly $900,000.

Once you do own land, you can CREATE whatever you want. This includes basic buildings, virtual businesses, Discos, amusement parks, or mini-games.

If you own nft arts, you can display it around your parcel of land. In this case inside the building.

To access this virtual world you don’t need to own any land. You can simply log in and start EXPLORING the different parts of this world. This world also has multiple virtual casinos. One such casino is owned by Atari. You can bet ETH, USDT, DAI, and MANA (The native token).

The next big attraction is the NFT galleries, where NFT art is kept on display and can be bought. You will often find the artist near the NFT art (Just like physical art galleries). Virtual concerts are also held on Decentraland.

How does it work?

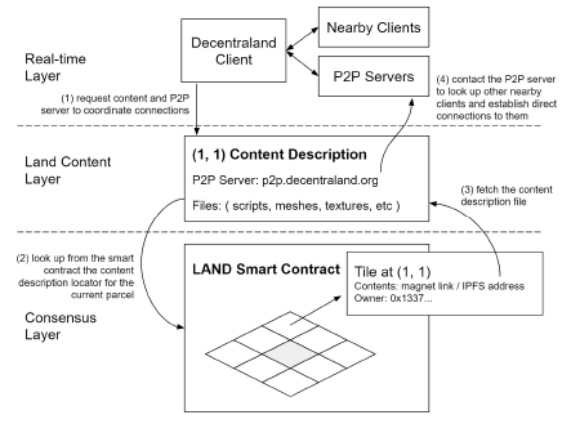

Just like many blockchain projects, it has a protocol and that protocol has three layers. These are the consensus layer, the land content layer, and the real-time layer.

• Consensus layer: Track land ownership and its content.

• Land content layer: Renders or displays everything you see when you enter Decentraland.

• Real-time layer: Provides the peer-to-peer connections that are required for users to interact with one another.

What is the utility of the token?

Mana (ERC-20 token) is the native token of Decentraland. It is primarily used as the medium of exchange within the virtual world. It is used to buy and sell land & is also used to Gamble in virtual casinos.

Unlike its peers, Decentraland is completely decentralized and is controlled by the Mana holders through the Decentraland DAO (Decentralized autonomous organization). The DAO owns the most important smart contracts and assets that make up Decentraland – the LAND Contract, the Estates Contract (Estate is a collection of Lands grouped. It is also an NFT), Wearables (Your Clothing within the game which is also an NFT), Content Servers, and the Marketplace.

Holders of Mana get 1 vote each for each token while Land and Estate holders get 2000 votes.

This truly gives the Mana holders control over all the important aspects of the project.

Tokenomics

Mana had an initial total supply of 2.8 billion tokens. It was initially deflationary as Mana used to purchase land during the launch of Decentraland was burnt. Along with genesis burn, 2.5% of every transaction within Decentraland was burned. A total of 600 million tokens were burnt.

However, this changed at the starting of this year. Mana holders voted to reallocate the would-be burnt tokens to the community’s treasury.

The current circulating supply is now 1.58 out of the total supply of 2.19 billion (72%) tokens.

Industry and competitive analysis.

Decentraland is operating within three Giant industries. The Gaming industry, NFT industry, and the Casino industry.

The global gaming industry is worth more than $300 Billion & the gambling market is expected to be more than $525 Billion alone by 2023.

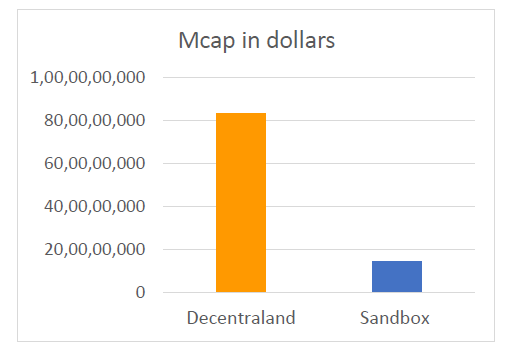

In the cryptocurrency space, Decentraland dominates the closest competition “Sandbox” based on Market capital.

| Project | Mcap |

|---|---|

| Decentraland | $833,453,330 |

| Sandbox | $143,026,232 |

Team, Media, and community strength.

The project was conceptualized and developed by two blockchain experts. These two, Ari Meilich and Esteban Ordano, spent several years developing the blockchain and the smart contracts that run Decentraland. Post-launch, they both stepped back into an advisory role, allowing the Decentraland DAO provides the way forward for Decentraland

Grayscale has a Decentraland trust which has $8.3 Million. Binance is also holding $72 Million worth of Mana.

Their community strength is excellent with over 142,000 Twitter followers.

Conclusion

Pros:

1) The project is truly Decentralized as the founders have taken a step back and allowed the DAO to take over. The Dao represents the Mana and landholders. They will likely have the best interest of the project.

2) The overall industry it caters to, is worth beyond 100 billion dollar.

3) It dominates its peers (Sandbox) and is the market leader.

Cons:

1) Decentraland averaged about 10,000 daily active users in March. This is not a great sign as the success of any game depends on its adoption. It needs to catch up with the industry.

MintingM rating for Decentraland is 3.5/5

| Criteria | Score |

|---|---|

| Industry | 5 |

| Opportunity Size | 3.5 |

| Competitive advantage | 4.22 |

| Tokenomics | 2.25 |

| Team | 2.5 |

| Overall Score | 3.5 |

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today