Cryptocurrency Taxation in India FAQs

In the absence of clear laws and regulations for the taxation of cryptocurrency in India, we at MintingM have compiled a list of frequently asked questions (FAQs) concerning the crypto community. We have tried to keep the language simple and lucid for all to understand. This document purely expresses our independent view and may or may not conform with the view of other experts or even the Government of India Tax Department and hence should not be construed as any form of advice. We urge you to consult your tax expert/CA for any questions or queries you may have.

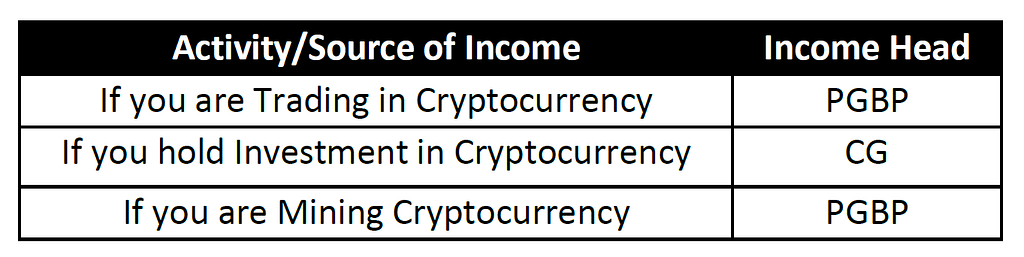

What are the different heads under which crypto gains or loss can be taxable in India?

Section 14 of the Income Tax Act provides for income to be computed and taxed under various heads such as Income from Salary, Income from House Property (HP), Income from Profit & Gains from Business or Profession (PGBP), Income from Capital Gains (CG) and Income from Other Sources (IFOS). Of the above, we opine that cryptocurrency gains and loss can be shown under Income from Profit or Gains from Business or Profession (PGBP) or Income from Capital Gains (CG) as the case may be. Since our laws do not recognize or define gains/losses from cryptocurrencies, we believe the most prudent way to account for tax would be as follows –

Is trading in cryptocurrency on crypto exchanges speculative in nature for taxation purpose?

Now there are two views to this question, one which is favourable to the interest of the taxpayer and the other which is probably more rational and may also be supported by the tax authorities. In the absence of any regulation, we are only deliberating as to what could be an ideal approach in a situation where someone is trading in cryptocurrency.

Not considered as a speculative transaction: Speculative transaction is defined as a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scrips. The act also specifies certain exclusions to the above definition. According to the above definition, trading in crypto will not fall under speculative transactions as it only covers transactions for commodity, stocks and shares and crypto is neither commodity nor stocks/shares or securities. The income/gain from crypto trading will anyways be taxed under the head of Business or Profession at the marginal rate of tax applicable.

Considered as a speculative transaction: Intraday trading in the equity market is considered as a speculative transaction and income and gains although taxed under the head of Business income is to categorized as speculative income. Drawing an analogy from this, we can probably assume that intraday trading on cryptocurrency can also be considered as a speculative transaction and taxed at an applicable slab rate.

I am an investor in the crypto market? How do I pay taxes?

In the absence of clear laws and regulation, a prudent investor needs to pay taxes on cryptocurrency income/gains under the head of Capital Gains. Any profit or gain that arises from the sale of a ‘capital asset’ is a capital gain. The act defines a capital asset as property of any kind held by an assessee, whether or not connected with his business or profession. Since the definition is exhaustive and the nature of cryptocurrency as an asset class and the motive of investment makes it most rational to tax it under the head Capital Gains. There are 2 types of Capital asset, short-term capital asset is held for 36 months or less and long-term capital asset is held for more than 36 months. Capital gains on Short-term capital assets are taxed at prevailing slab rates of the tax-payer and gains on long-term capital assets are taxed at 20%.

What is the tax bracket for Crypto gains in India?

In the absence of any laws or regulations, tax on cryptocurrency gains will depend upon which head of income it is shown under. If the income is shown under Profits or Gains from Business or Profession, then taxes will be charged under applicable tax slabs. If income is shown under Capital Gains, then it could be taxed as Short-Term Capital Gain (STCG) or Long-Term Capital (LTCG) depending on the period of holding of the cryptocurrency. So, if the crypto is held for less than 36 months or less, STCG will be applicable and would be taxed at prevailing tax slabs. If the crypto is held for more than 36 months, LTCG will be applicable along with the benefit of indexation and taxed at a flat rate of 20%.

Do we need to pay taxes on realised cryptocurrency gains only?

In the case of an investor, the gains or loss are realised only on the sale of the crypto assets. However, if the sale proceeds are not converted into fiat currency till the end of the financial year, then the value of the gains or loss, realised in the form of crypto assets (stable coins) should be converted into the fiat currency as on the last day of the financial year, to determine the actual profits or loss. If you are a trader, then the valuation of unsold crypto assets lying in the form of closing stock needs to be done at cost or market value whichever is less.

Do we need to compute the gains or loss on conversion to INR only?

No, this is not true. The taxable events include

• Cryptocurrency to Fiat Currency

• Cryptocurrency to Cryptocurrency

• Cryptocurrency to Goods/Services

The non-taxable events include

• Fiat Currency to Cryptocurrency

• Transfer from Crypto Wallet to Crypto Wallet

If I receive cryptocurrency as a gift from my relatives, is it taxable?

Since cryptocurrency in itself is not defined by the laws, it is difficult to comment if it should be taxed as a currency, commodity or capital asset. Nevertheless, we would draw an analogy from current tax laws which talk about cases when taxes will be applicable on receiving gifts from relatives. As per current laws, u/s Sec. 56 when movable properties are received without consideration and the aggregate fair market value of such properties exceeds Rs. 50,000, the whole of the aggregate fair market value of such properties shall be chargeable to tax in the hands of the recipient.

Also, if movable properties are received for a consideration that is less than the aggregate fair market value of properties by an amount exceeding Rs. 50,000, the difference between the aggregate fair market value and the consideration is chargeable to tax. As defined in the act, Movable property shall include shares, securities, jewellery, archaeological collection, drawings, paintings, sculptures, any work of art or bullion etc. Thus, since the definition is exhaustive, using a prudent and conservative approach, one may tax the gift in the hands of the recipient under the head Income from Other Sources (IFOS). But the act also specifies certain circumstances when the transfer/gift will not be chargeable to tax, one of which is when the gift is from a relative. But it is important to note that a “relative” is clearly defined in the act.

Can Corporates and Institution trade/invest in Crypto? What would be the impact on taxation?

Anyone can trade/invest in cryptocurrency subject to fulfilment of KYC norms. At present, no Government or Regulatory body has prohibited any individual or corporate from trading, investing or transacting in cryptocurrency. Any corporation dealing in cryptocurrency has to certainly offer the incomes and gains that arise from these transactions to tax. The rate of tax will depend on the nature of crypto holdings and the income head under which it is offered for tax as the case may be. Also, the Ministry of Corporate Affairs (MCA) has asked all companies in the country to mandatorily disclose any dealings in cryptocurrency or virtual currency in their balance sheets. The companies have to disclose profit or loss on transactions involving cryptocurrency or virtual currency, the amount of holding, and details of deposits or advances from any person for the purpose of trading or investing in cryptocurrency or virtual currency.

What do we do if one makes a loss in cryptocurrency investing/trading in a financial year?

The Income tax laws allow for set-off and carry forward of losses under certain circumstances as defined in the regulations. Set-off of losses means adjusting the losses against the profit or income of that particular year. Losses that are not set off against income in the same year can be carried forward to the subsequent years for set off against income of those years. This makes it important to disclose losses in the annual returns of income to be filed. In the table below, we discuss how to set off and carry forward losses arising from cryptocurrency,

What is the tax implication on bitcoin mining?

Bitcoin mining can be considered a commercial activity. It is performed using very sophisticated computers that solve extremely complex computational math problems. Mining is also an expensive task. Hence, we believe mining is certainly a business activity and any gains/income should be offered to tax after deducting all expenses incurred to mine bitcoin. The Income Tax Act gives the following definition, “Business includes any trade, commerce or manufacture or any adventure or concern in the nature of trade, commerce or manufacture.” Hence a more conservative and prudent approach will be to show mining income/gain under the head Profits or Gains from Business or Profession provided we can estimate can for incomes and gains from mining bitcoin accurately.

Can I accept cryptocurrency for services I provide or products I sell? Do I have to pay taxes?

Firstly, Cryptocurrency is not a currency or a legal tender which is recognised by Reserve Bank of India. Also, there are no restrictions that prohibit someone from accepting cryptocurrency as a consideration for sale of service or product. As mentioned in Section 28(iv) of the Income Tax Ac, the value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession is chargeable to tax under the head Profits and gains of business or profession. Hence it is certain that even if you receive cryptocurrency as a consideration in the course of your business, you need to offer the income/gains to tax. If the motive is to transfer or sell the cryptocurrency and use it as mode of payment for expenses incurred, then accounting for crypto should be done as an inventory and taxed accordingly. Any gains from this would fall under income from profits or gains from Business or Profession. Also, gain or loss would be determined based on fair market value of goods or services purchased against fair market value of goods or services sold.

Is GST applicable on crypto transactions?

If we consider cryptocurrency as money, it would be exempted from GST as a pure transaction in money does not attract GST as per the Act. But on the other hand, the treatment of cryptocurrency as goods/property would mean that the supply of coin/token is a ‘taxable supply and will be subjected to GST. Since the regulations are silent, no GST is being charged on the commissions and fees levied by the crypto exchanges on the users.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today

Disclaimer: The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice. Please do your research before investing.