Research summary:

Celsius is a CeFi application (live and operating) that allows anyone to earn interest on your crypto, borrow crypto, buy, swap and send crypto. It aims to disrupt the current traditional banking ecosystem and provide economic freedom to the general public via crypto. We will focus on how the project works and review its pros and cons.

The CMP of CEL is $0.556 as of 17th June 2022

What is Celsius Network?

Celsius Network is an application that operates in the finance industry and is trying to disrupt two major sectors. They are the banking industry and the crypto exchange industry which are both worth upwards of multiple billion dollars.

The company has been quite critical regarding the traditional banking system and how they have paid almost no returns on deposits and charge exorbitant interest rates and fees on loans. Here is how Celsius comes into the picture, they are providing people an opportunity to earn passive income on their crypto as many people have been hodling their crypto on their exchange accounts or hardware wallets. Similarly, it allows investors to take crypto-based loans.

It allows investors to buy new crypto via fiat, which is the main function of an exchange, however, it also allows investors to send crypto to others and swap crypto for another address without any gas fees.

It is currently ranked at #147 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 695 million CEL tokens out of which (34%) 238 million CEL tokens are in circulation. CEL is currently listed on FTX, OKX, and MEXC

How does Celsius work?

Although quite critical regarding the banking system, Celsius’s primary function is the same as the banks. They take deposits in the form of crypto and pay interest on it. They advertise that they give up to 17% APY however they only pay 6.5% on Bitcoin holdings. The highest APY is of 14% on SNX tokens

Similarly, you can borrow crypto by posting collateral. The loan-to-value ratio stands at 25% on account of the volatile nature of cryptocurrency and you need to pay an interest of 12% (annual rate) monthly.

So if you are taking a loan of 25,000 USDC, you will need to post collateral of 100,000 USDC and pay an interest of 250 USDC per month.

The motivation from the lender’s point of view is to earn passive income while borrowers can use Celsius to increase their leverage on their position. Let’s say that the investor is confident that BAT is about to surge, so he can borrow money and keep BAT as collateral. He will then buy more BAT with the borrowed money. So, when BAT surges, the borrowed BAT’s new value minus the principal and interest would be the profit. Another common reason to borrow money is to suffice temporary cash crunch without selling your crypto.

How does Celsius provide returns to the depositors?

A normal bank has always generated returns for its depositors by lending crypto at a higher rate. Celsius however does not follow this strategy.

Celsius is primarily used to generate returns via lending out the depositor’s crypto to approved institutions and exchanges for approximately 9% returns. This was a tested strategy and often employed by the traditional banks as well. However, ever since DeFi became mainstream and provided a lot of opportunities Celsius started taking more and more risk to achieve higher returns.

Can Celsius go bankrupt?

Normally a bank goes bankrupt if there is a significant imbalance between the assets (Loans) and the liabilities (Deposits). The imbalance often widens when there is a “run on the bank” event. When the public loses confidence in the bank to hold their money, the public rushes together to withdraw their deposits. This is referred to as the “Run on the bank” event.

This is a risk that banks have to deal with and this applies to Celsius as well. Besides the traditional risks, Celsius has to worry about cybersecurity risk, liquidation risk, liquidity risk and more as Celsius started deploying capital in DeFi protocols.

Celsius has already been a victim of multiple hacks and system crashes. It had lost approximately $50 million in depositors’ crypto in the BadgerDao Hack while it lost approximately $500 million in the Terra Luna crash.

The above-mentioned money is the people’s money and has led to an imbalance between the assets and the liabilities. Celsius had mentioned that they had approximately $11 billion in people’s money (Liabilities) while onchain data indicates that they only have $3.8 billion. This includes $400 million in Ethereum which is locked in the beacon chain and hence illiquid and not available to give back to the market. They also have $1.5 billion in stETH which is supposed to have the value of ethereum. Due to a lack of liquidity, stETH is also losing its value against Ethereum. They also have a $500 million wBTC position on Makerdao with a liquidation price at $13,600.

Clearly there is a significant imbalance between the assets and liabilities and there are a lot of confirmed events and data that indicates that they currently cannot honour any withdrawals. This is evident by the fact that they have paused all withdrawals.

The clients on the platform are also complaining about the fact that they need to deposit money in their account to square off their loan, even though there is sufficient money in their account. This is strongly indicating that the investors deposits on their platforms might have reduced significantly.

So Yes, Celsius can definitely go bankrupt, and based on what is happening now, it is definitely going to be restructured or it can go bankrupt.

Tokenomics

CEL is the native cryptocurrency of Celsius. It has a total supply of around 695 million tokens, of which (34%) 238 million tokens are in circulation.

The Token is not a governance token but rather is an incentive-based token. You can take out a loan in CEL and pay less fees, similarly, you will get bonus interest on the deposits if you receive your interest in CEL.

CEL token has been quite volatile as there are rumors that they are bankrupt and they could potentially be receiving a bailout in the form of a loan.

Competition Analysis

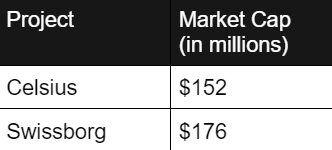

Celsius vs SwissBorg

Swissborg is a wealth management application whereas Celsius is a CeFi application. Swissborg is community-centric which means it is democratic and is different from Celsius as it runs independently without being community-driven. Swissborg’s app is easy to use and very simple but on the other hand, Celsius has a variety of services to offer to its user.

Team, Media, and Community Strength

Alex Mashinsky is the co-founder of Celsius. Alex is one of the inventors of VOIP (Voice Over Internet Protocol), and he is currently working on MOIP (Money Over Internet Protocol) technology.

S.Daniel Leon is the co-founder and Chief Strategy Officer. Daniel has co-founded and led a number of businesses and non-profit organizations. He graduated from Brown University with a degree in Economics.

They have over 249.9K followers on Twitter, in the span of 5 years. Recently, they have been mentioned in a number of articles because of their Equity Capital getting exhausted and Celsius making a statement that it would keep the cryptos of all users if the company goes bankrupt.

Conclusion

Celsius unlike other platforms is centralized and has an excellent mission statement. They however have unfortunately taken risks that have not paid off. They have suffered significant losses and most of the investors’ money is illiquid. They have stopped withdrawals and will require either a bailout to avoid bankruptcy.

This will unfortunately leave the investors hanging. All 1,700,000 investors who apparently called Celsius their home for crypto.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today