Research summary:

Anchor Protocol is a Defi protocol (live and operating) that allows anyone to earn interest on their money. It aims to shape the current DeFi ecosystem and make it suitable for mass adoption. We will focus on how the project works and review its pros and cons.

The CMP of ANC is $3.06 as of 8th April 2022

What is DeFi?

All of the traditional financial services are centralized (controlled by a single authority or managed in one place) in nature. The Risks and problems that come with centralized financial services are Fraud, Mismanagement of funds, Theft, and restrictions to use your own money. DeFi stands for Decentralized Finance (DeFi is a category of Dapps. Dapps are decentralized applications that are launched on networks such as Ethereum). It is a financial service with no central authority. It eliminates these problems by allowing people to have complete custody and control of their money and to get more returns, by eliminating the 3rd party.

There are various categories of DeFi

- Money Market: Such applications enable users to borrow assets against collateral and earn interest. Maker, Aave, and Compound are the top DeFi applications in this category.

- Decentralized exchange: These kinds of applications give users the ability to swap one crypto for another. Uniswap and SushiSwap are the top DeFi applications in this category.

- Derivatives: A derivative contract derives its value from an underlying asset. With the help of smart contracts, DeFi projects like Synthetix allow people to get exposure to a wide variety of assets.

The DeFi space has seen explosive growth over the past year. The graph below indicates that 79.48 billion dollars are currently involved in the DeFi space.

What is Anchor Protocol?

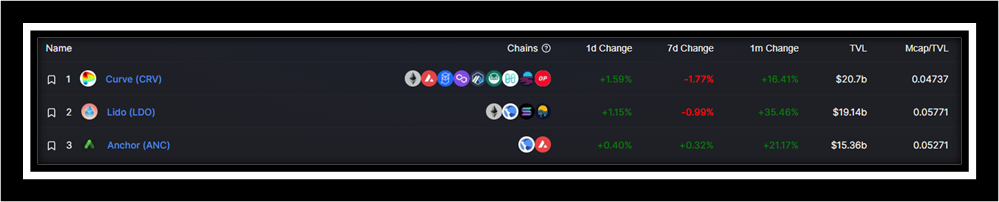

Anchor Protocol is a borrowing and lending protocol built on the Terra blockchain by Terraform Labs. It is the 3rd largest DeFi protocol and has close to $15.52 billion in total value locked.

DeFi was one of the 1st niches within the cryptocurrency space that started booming as the crypto community realized its true potential. This led to a strong influx of brain and capital within the space however DeFi is still complicated. You need to jump through hoops to earn that extra yield and it is acting as a barrier when it comes to mass adoption. The team behind Anchor Protocol realized that a simple “Savings Account” which is considered to be the most popular financial instrument in the world would eliminate the complexity barrier and is the move forward. Anotherbarrier when it comes to mass adoption is “Volatile deposit interest rates” and this is an issue associated with the top lending and borrowing DeFi peers like Compound Finance. To counter this issue, the Anchor protocol provides a stable deposit interest rate of approximately 20%.

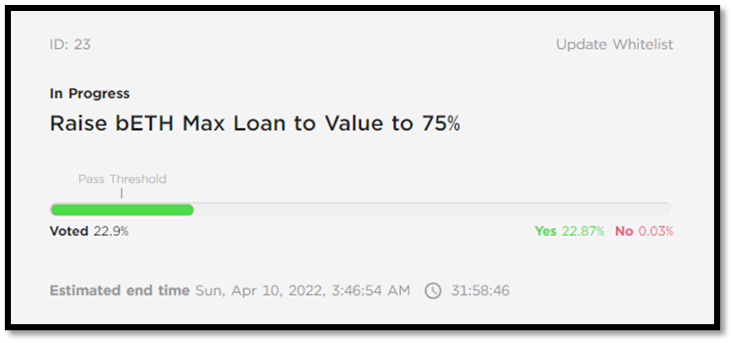

The protocol is decentralized and is managed by ANC token holders. Proposals are brought to the token holder’s attention and holders can vote “Yes” or “No”.

It is currently ranked at #94 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 1 billion ANC tokens out of which (28%) 27.6 billion ANC tokens are in circulation. ANC is currently listed on Binance, Kucoin, and Huobi Global.

How does Anchor Protocol work?

In Anchor Protocol, you can borrow and lend money in a decentralized manner. There isn’t any requirement to fix the specification of a loan or meet anyone. This is possible with something referred to as a liquidity pool.

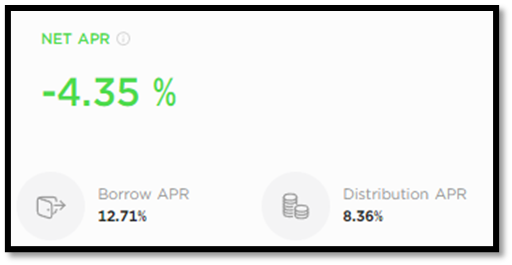

A liquidity pool can be viewed as a bowl of money, lenders can deposit UST in the bowl for approximately 20% annual interest rate while the borrowers can borrow money from the bowl for a certain interest rate (-4%, yes, it is negative. More on this below).

The borrower has to deposit collateral in the form of liquid staked PoS assets from major blockchains (It only supports Ethereum and Luna at the moment) to borrow money.

To make sure that the value of the collateral does not drop significantly (due to the volatility in the crypto space) compared to the loan amount, the protocol overcollateralizes. LTV stands for loan to value ratio, so if I want to borrow $100 worth of Ethereum, I will have to deposit $120 worth of Ethereum.

The motivation from the lender’s point of view is to earn passive income while borrowers can use the protocol to increase their leverage on their position. Let’s say that the investor is confident that BAT is about to surge, so he can borrow money and keep BAT as collateral. He will then buy more BAT with the borrowed money. So, when BAT surges, the borrowed BAT’s new value minus the principal and interest would be the profit. Another common reason to borrow money is to suffice temporary cash crunch without selling your crypto.

How does it provide ~20% returns?

The explanation is quite simple and “Staking” is an important factor. Staking is an essential aspect of the “Proof of Stake” consensus mechanism. Unlike “Proof of work”, PoS randomly selects a validator to forge the new block and is accordingly rewarded. To ensure that the validators do not have any malicious intentions, they need to put the skin (or stake) in the game. If you do something wrong, you lose their stake.

The borrower has to deposit staked Ethereum (bETH) or staked Luna (bLUNA) as collateral to borrow. The staking rewards generated from the collateral go to the anchor protocol. The staked rewards along with the interest on the outstanding loan serves as the reward for the depositors. If the rewards exceed 20% of the deposited value, then the extra money goes into a Yield reserve. The purpose behind the yield reserve is to compensate the depositors when the staked rewards and the interest on loans don’t achieve a 20% interest rate.

Let’s look at the current numbers as of today (8th April). The total deposit value stands at – $ 12,308 million. So, a 20% interest would account for $1,230 million

Staked rewards arising out of Terra account for 6.4% of the staked value which is $281 million and the rewards arising out of staked Ethereum account for $62.5 million. The current 12.71% APR on borrowed funds accounts for ~$432.33 million.

So, the overall revenue that Anchor generates comes down to $775 million while the 20% rewards to the depositors sit at $1,230 million. Anchor protocol is falling short of $454 million and if the yield reserve (328 million) is completely deployed to shorten the gap, there will still be a gap of $126 million.

What is the utility of the ANC token?

The only way to reduce the gap is to increase borrower’s interest so that they can deposit staked collateral and pay interest. To achieve this the native token “ANC” comes into play. Not only does it act as a governance token but it is also used to incentivize the borrowers. Today you are paid to borrow money from the protocol in the form of ANC tokens.

ANC is designed to grow along with the Anchor’s AUM and distributes protocol fees to the ANC stakers. One concerning aspect is that the token issuance will end within a few years.

Competition analysis.

When it comes to the DeFi space, Anchor is the 3rd largest Dapp based on total value locked (TVL) and the 2nd largest Dapp in the lending category.

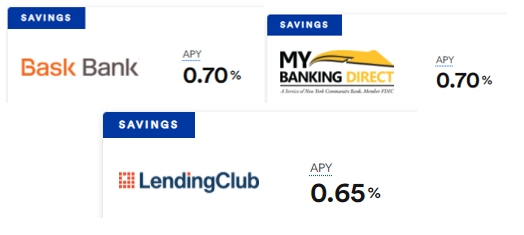

It has gained tremendous traction in the last year, as last April it only had a TVL of 0.5 billion. Besides its crypto peers, the traditional banks are also a competition. It has an amazing edge over the banks in developed nations.

Team, Media, and community strength.

The Anchor protocol is governed by its token holder community.

Anchor protocol has excellent community strength. They have 200k Twitter followers, 40k telegram followers, and 19k discord members. Their media strength is mediocre.

Conclusion

Pros: Anchor protocol has created a solution that is perfect for mass adoption as it not only focuses on the most popular financial product but also tries to provide a stable interest rate. It is one of the largest DeFi applications and has close to $15.4 billion. It is a DeFi protocol that is governed by the token holders and has huge market potential as it is trying to take over the primary role of the banks which is a multibillion-dollar industry. Keep in mind that the depositors earn 19.5% as of now.

Cons: Anchor protocol faces several challenges. The 1st one is regulation. DeFi falls just behind Bitcoin when it comes to regulator’s priority as DeFi serves as a replacement to the existing traditional and extremely regulated financial industry. The 2nd challenge or a potential issue is that most of the value locked is in the form of UST which is an algorithmic stablecoin. Although there is a risk of UST losing its peg (similar to the Iron Finance fiasco), Terra has been working on reducing the risk by creating a Bitcoin reserve for UST. The tokenomics is also a concerning factor as the issuance is quite high and is serving as an incentive to borrow.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today