Research summary:

AAVE is an open-source Defi protocol (live and operating) that allows anyone to earn interest on their money without any aspect of KYC. We will focus on how the project works, what value it adds, and review its pros and cons.

The CMP is $170 as of 25th March 2022

What is DeFi?

All of the traditional financial services are centralized (controlled by a single authority or managed in one place) in nature. The Risks and problems that come with centralized financial services are Fraud, Mismanagement of funds, Theft, and restrictions to use your own money. DeFi stands for Decentralized Finance (DeFi is a category of Dapps. Dapps are decentralized applications that are launched on networks such as Ethereum). It is a financial service with no central authority. It eliminates these problems by allowing people to have complete custody and control of their money and to get more returns, by eliminating the 3rd party.

There are various categories of DeFi

- Money Market: Such applications enable users to borrow assets against collateral and earn interest. Maker, Aave, and Compoundare the top DeFi applications in this category.

- Decentralized exchange: These kinds of applications give users the ability to swap one crypto for another. Uniswap and Sushiswapare the top DeFi applications in this category.

- Derivatives: A derivative contract derives its value from an underlying asset. With the help of smart contracts, DeFi projects like Synthetix allow people to get exposure to a wide variety of assets.

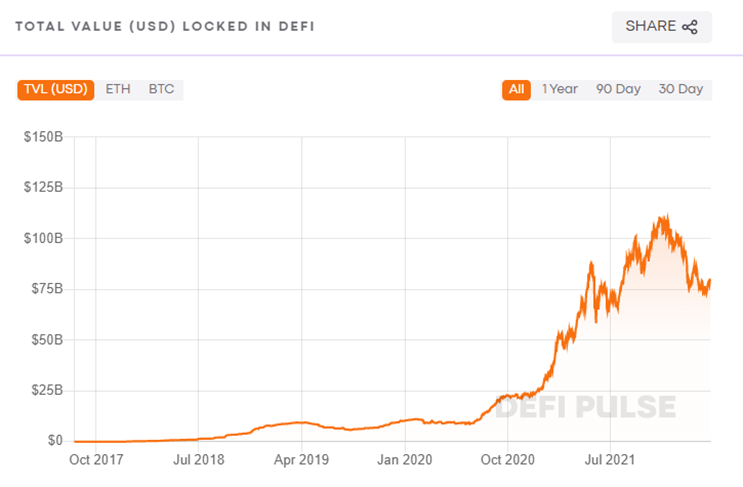

The DeFi space has seen explosive growth over the past year. The graph below indicates that 77.11 billion dollars are currently involved in the DeFi space.

What is AAVE?

AAVE is a non-custodian decentralized borrowing and lending platform. It takes over the bank’s primary role of being the intermediary of borrowing and lending money. It completely saves the banks margins and gives them to the borrower and the lender. There is no lengthy process of conducting KYC, no need to travel to any location and it is completely accessible. All you need to do is create a Web 3 wallet to get started. This eliminates all the risks that are associated with bank and it also gives investors the opportunity to earn passive income on their cryptocurrency.

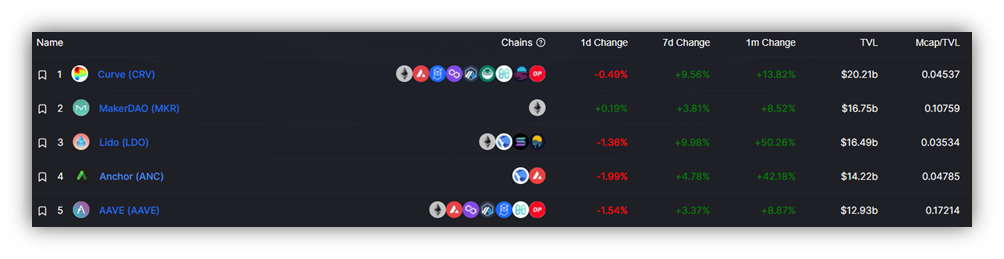

It operates on not just the Ethereum network but rather functions on six other networks. The total value locked (TVL) with AAVE is $13.12 billion and has a Mcap-TVL ratio of 0.1775.

The protocol is audited, open-source and it managed by AAVE token holders making it one of the most decentralized DeFi protocol. It is currently ranked at #52 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 16 million AAVE tokens out of which 13.6 million AAVE tokens are in circulation. AAVE is currently listed on Binance, Coinbase, and FTX.

How does AAVE work?

In AAVE, you can borrow and lend money in a decentralized manner. There isn’t anyone any requirement to fix the specification of a loan or meet anyone. This is possible with something referred to as a liquidity pool.

A liquidity pool can be viewed as a bowl of money, lenders can deposit money in the bowl for a certain interest rate (reward) while the borrowers can borrow money from the bowl for a certain interest rate (fee). The bowl in the case of AAVE would be a smart contract and not a bank. The rates are also dynamic and change based on the demand and supply of an asset.

You can borrow and lend 30+ ERC20 tokens, the top tokens are Ethereum, USDC, and WBTC. The lender earns interest in the form of aTokens (which are pegged 1:1 against the underlying asset). The advantage here is that aTokens are not exclusively used in the AAVE protocol and can be sold in the secondary markets via Decentralized exchanges (such as Uniswap).

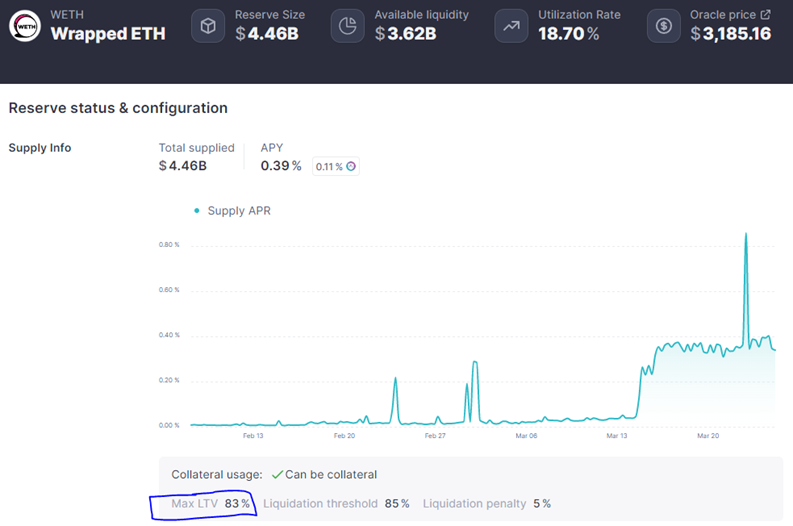

To make sure that the value of the collateral does not drop significantly (due to the volatility in the crypto space) compared to the loan amount, the protocol overcollateralizes. LTV stands for loan to value ratio, so if I want to borrow $100 worth of Ethereum, I will have to deposit $120 worth of Ethereum.

The motivation from the lender’s point of view is to earn passive income while borrowers can the protocol to increase their leverage on their position. Let’s say that the investor is confident that BAT is about to surge, so he can borrow money and keep BAT as collateral. He will then buy more BAT with the borrowed money. So, when BAT surges, the borrowed BAT’s new value minus the principal and interest would be the profit.

If an investor wants to take out a quick loan without collateral, then he or she can the flash loan feature. It is a feature designed for developers and a fair bit of technical knowledge is required.

Flash Loans allow you to borrow any available amount of assets without putting up any collateral, as long as the liquidity is returned to the protocol within one block transaction (or 15 seconds). Flash loans are primarily used to make significant amounts of money via arbitrage. Flash loan was recently on the news as a developer redeemed claimed 1.1 million dollars’ worth of ApeCoin during its airdrop.

The owners of the famous bored ape NFT could claim ApeCoins. Unfortunately, ApeCoin airdrop was not handed out based on who owned which Bored Ape at a particular time in the past but rather was handed out based on the present ownership at the time of redemption. This allowed a clever developer to take a flash loan, buy an NFT vault with Bored Apes (With unclaimed airdrop tokens), redeem the ApeCoin, sell the Bored Apes back to the market, and pay back the flash loan with interest.

Institutional investors interest

The common differentiating factor between the traditional finance industry and DeFi is that most of the DeFi protocols are not equipped for institutional investors. However, AAVE is an exception. At the start of the year Aave launched Aave Arc. It is a permissioned liquidity pool specifically designed for institutions in a bid to maintain regulatory compliance in the decentralized finance space.

Taurus Group, a Fintech firm, has also integrated Aave Protocol into its asset infrastructure, allowing banks and exchanges to deposit and borrow digital assets.

Several institutional investors have invested in Aave as well. Here are a few highlights.

- Grayscale, the world’s largest digital asset manager has launched a DeFi fund and AAVE represents 12.3% of the portfolio.

- AAVE also represents a large 14.07% of the Bitwise’s (another digital asset manager) DeFi Crypto index fund

What is the utility of the AAVE token?

AAVE is an ERC-20 native token to the Aave ecosystem. It is deflationary in nature and is a governance token. The token holders can put forth proposals and can also vote on proposals. These proposals can be used to shape the future of the protocol.

You also have an option of staking your AAVE token and earn rewards.

Competition analysis.

When it comes to the Defi space, Aave is the 5th largest Dapp based on total value locked (TVL) and is the 3rd largest Dapp in the lending category.

Among the top 3 lending protocols, it is the only one that is on multiple chain. More importantly it is on Polygon. This alone gives Aave an edge over the other protocols.

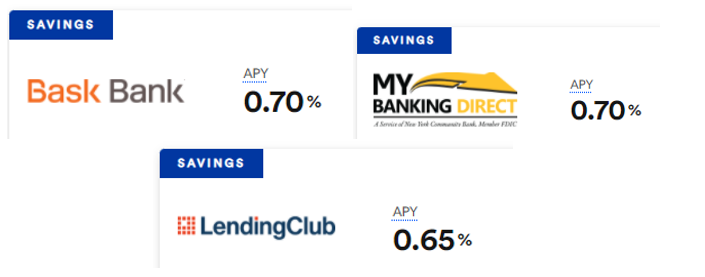

Besides its crypto peers, the traditional banks are also a competition. It has an amazing edge over the banks in developed nations. 0.7% found at US savings account is always beaten by the APY available on Aave.

Team, Media, and community strength.

The Aave protocol is governed by the 107,345 token holder community and is one of the most decentralized DeFi protocols.

Aave has excellent community strength. They have 442k Twitter followers, 15k telegram followers, and 22k discord members. Their media strength is also quite strong.

Conclusion

Pros: Aaveis the 5th largest Dapp and the 3rd largest Lending protocol in the DEFI space. It is one of the most decentralized DeFi protocols and has huge market potential as it is trying to take over the primary role of the banks which is a multibillion-dollar industry. Unlike most of the top DeFi protocols, Aave is not exclusive to a specific chain but rather operates on 7 different chains including Ethereum and Polygon. It also has high institutional interest.

Cons: Aave could face 1 major challenge and it is regulation. DeFi falls just behind Bitcoin when it comes to regulator’s priority as DeFi serves as a replacement to the existing traditional and extremely regulated financial industry. Aave’s flagship feature, “Flash loans” has been a hot topic and has been associated with hacks. The above-mentioned event on Apecoins airdrop is considered as an exploit by many in the community.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today